skip to main |

skip to sidebar

Ever have too much money?

Ever have too much money?

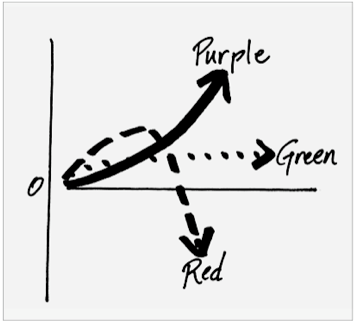

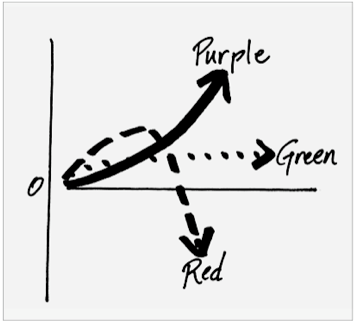

PURPLE CURVE INSIGHT #3

Constraints Management is based on uncommon common sense.

Consider cashflow. Which curve would be best?

You alone decide which curve to follow.

The purple curve represents uncommon common sense!

Can throwing money at a problem fix it?

Perhaps. Perhaps not. Why gamble, would it not be better to think it through, and know the best solution for any challenge you are facing?

It is rare when a business has too much cash on hand; in fact, I would suggest that it is not possible. Again, remember that I am only concerned with privately held firms. There is little common sense on Wall Street.

Years ago, one of my first clients taught me a thing or two about cashflow. More accurately, about cash. He said, "Never run out of cash." Sorry if that seems too obvious. It is not. Otherwise very smart business owners make this mistake year in and year out.

Hence, the Purple Curve Effect.

Look at the chart one more time. What if you make 200% profit on every sale, but it takes 90 or 120 or 180 days (or longer!) to collect your money? What if that new high-tech solution will increase your profits by another 200%? Do you buy it? If so, when do you buy it.

Did I mention that businesses are systems?

Holistic

Without sufficient cashflow, it does not matter how profitable your business "could" be... so, in the words of one smart entrepreneur:

Never run out of cash.

-ski

----

Jeff 'SKI' Kinsey, Jonah

Strategy, Tactics & Execution

Dover, OH | Hilton Head Island, SC | Las Vegas, NV

Cell: +1 330.432.3533

tag: Cash is King

©2008 Throughput.us LLC. All rights reserved.

Ever have too much money?

Ever have too much money?